Calculate loan payment student – As the topic of student loan payment takes center stage, this article delves into the intricacies of calculating and understanding these financial obligations, providing a comprehensive guide for students and graduates alike.

This article will explore the factors that affect student loan payments, such as loan amount, interest rate, and loan term. It will also discuss methods for reducing student loan payments, including refinancing, loan consolidation, and income-driven repayment plans.

Student Loan Payment Calculation: Calculate Loan Payment Student

Student loan payments are calculated using a formula that considers the loan amount, interest rate, and loan term. The formula is:“`Monthly Payment = (P

- r) / (1

- (1 + r)^(-n))

“`Where:* P is the principal loan amount

- r is the monthly interest rate (annual interest rate / 12)

- n is the number of months in the loan term

Factors Affecting Student Loan Payments

The cost of student loans can vary widely depending on several factors, including the amount borrowed, the interest rate, and the repayment term. These factors can significantly impact the monthly payments and the total amount of interest paid over the life of the loan.

Loan Amount

The amount borrowed is one of the most significant factors affecting student loan payments. The higher the loan amount, the higher the monthly payments will be. This is because the lender is spreading the total cost of the loan over a set number of months, so a larger loan will result in a larger monthly payment.

Interest Rate

The interest rate is another critical factor that affects student loan payments. The interest rate is the percentage of the loan amount that the lender charges each year. A higher interest rate will result in higher monthly payments and a higher total amount of interest paid over the life of the loan.

Loan Term

The loan term is the length of time over which the loan is repaid. A longer loan term will result in lower monthly payments but a higher total amount of interest paid over the life of the loan. This is because the lender is spreading the total cost of the loan over a more extended period, so the monthly payments will be lower, but the interest will accumulate for a longer period.

Methods for Reducing Student Loan Payments

Student loan payments can be a significant financial burden for graduates. However, there are several methods available to help reduce these payments, making them more manageable and allowing borrowers to pay off their loans sooner.

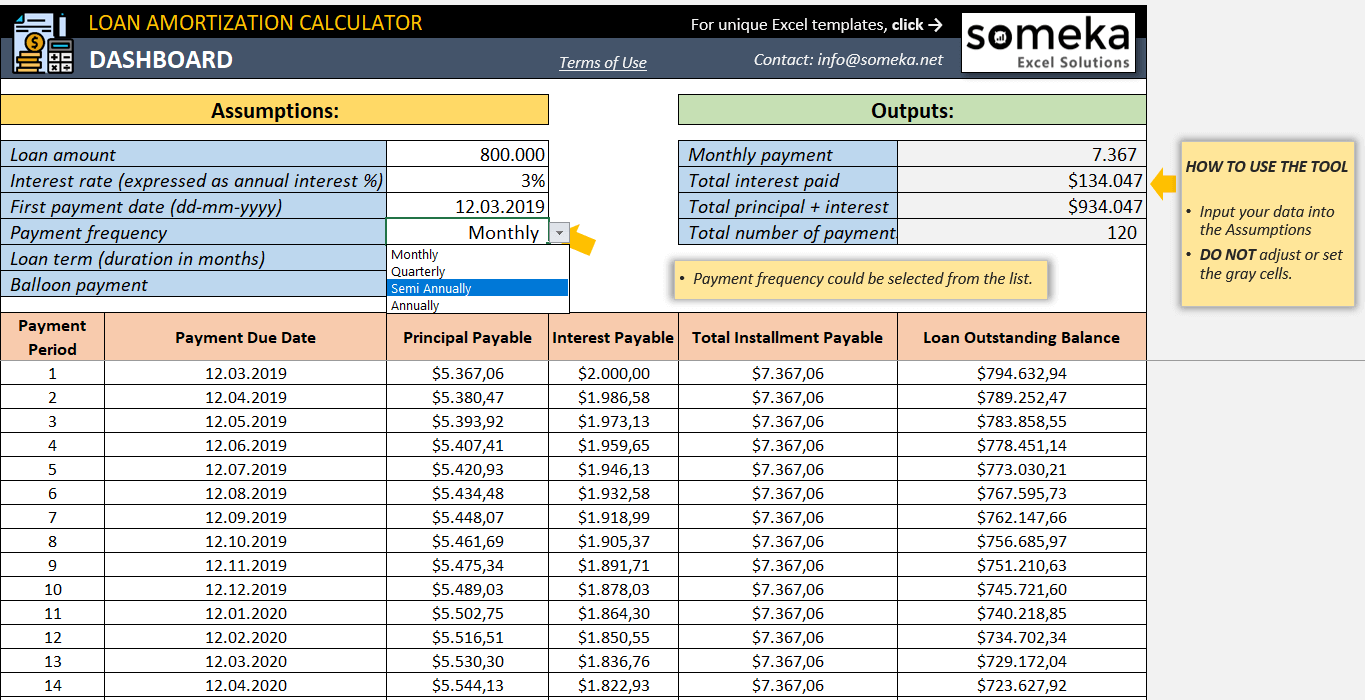

For students considering higher education, understanding loan payments is crucial. Tools like calculate loan payment student can assist in estimating monthly payments based on loan amount, interest rate, and repayment term. These calculations empower students to make informed decisions about borrowing and repayment, ensuring they can plan for their financial future.

Refinancing Options

Refinancing student loans involves taking out a new loan with a lower interest rate or better repayment terms. This can significantly reduce monthly payments and save borrowers money over the life of the loan.

Loan Consolidation

Loan consolidation combines multiple student loans into a single loan with a single monthly payment. This can simplify the repayment process and potentially lower the interest rate, resulting in reduced monthly payments.

Income-Driven Repayment Plans

Income-driven repayment plans are designed for borrowers who have difficulty making their student loan payments. These plans adjust monthly payments based on the borrower’s income and family size, making them more affordable.

Online Tools for Student Loan Payment Calculations

For convenient and accurate student loan payment calculations, online calculators offer a valuable solution. These tools provide a comprehensive assessment of loan details, enabling students to plan their repayment strategy effectively.

As students navigate the complexities of student loans, understanding repayment options is essential. Using resources like calculate loan payment student , students can determine their monthly payment amounts and the total cost of their loans. This knowledge enables them to budget effectively and plan for their financial obligations, empowering them to make responsible financial decisions throughout their academic journey and beyond.

Reputable online calculators include:

- Federal Student Aid Loan Simulator

- Bankrate Student Loan Calculator

- NerdWallet Student Loan Calculator

When using these calculators, it’s essential to provide accurate information, including loan amount, interest rate, loan term, and repayment frequency. These tools calculate monthly payments, total interest paid, and loan payoff date.

The benefits of using online tools for payment planning include:

- Accuracy and Precision:Calculators provide precise calculations, eliminating the risk of errors.

- Convenience:Online tools are readily accessible and can be used anytime, anywhere.

- Comprehensive Analysis:Calculators consider all loan details, providing a holistic view of repayment options.

- Planning and Forecasting:By inputting different scenarios, students can project potential payment amounts and plan their budget accordingly.

Case Studies of Student Loan Payment Strategies

Student loan debt has become a significant financial burden for many individuals. To address this challenge, various payment strategies have emerged, each with its unique advantages and drawbacks. This article examines successful student loan payment strategies, analyzing their impact on overall financial well-being.

Income-Driven Repayment (IDR) Plans

IDR plans adjust monthly payments based on income and family size. They offer lower payments for borrowers with lower incomes, making them an attractive option for those struggling with debt. However, IDR plans can extend the loan repayment period, resulting in higher interest payments over time.

Understanding the intricacies of student loan repayment is crucial for graduates navigating the post-education financial landscape. Tools like the student loan payment calculator can assist borrowers in accurately estimating their monthly payments and planning for the future. These calculators factor in key variables such as loan amount, interest rate, and repayment term, providing a clear understanding of the financial obligations associated with higher education.

Refinancing

Refinancing involves taking out a new loan to pay off existing student loans. This can secure a lower interest rate, reducing monthly payments and saving money on interest. However, refinancing may not be suitable for all borrowers, particularly those with good credit scores.

Loan Consolidation

Loan consolidation combines multiple student loans into a single loan with a fixed interest rate. This simplifies repayment by having one monthly payment instead of several. However, consolidation may not reduce the total amount owed or the interest paid.

Debt Snowball Method

The debt snowball method involves paying off the smallest loan balance first while making minimum payments on other loans. This provides a sense of accomplishment and motivation, but it may not be the most financially efficient strategy.

Debt Avalanche Method, Calculate loan payment student

The debt avalanche method prioritizes paying off the loan with the highest interest rate first. This strategy minimizes interest payments over time but may require higher monthly payments initially.Analyzing the impact of these strategies on overall financial well-being requires consideration of individual circumstances and financial goals.

IDR plans can provide immediate relief for borrowers with low incomes, while refinancing and consolidation may offer long-term savings. The debt snowball and avalanche methods can help borrowers build momentum and improve their financial discipline.By understanding the pros and cons of different student loan payment strategies, borrowers can make informed decisions to manage their debt effectively and achieve their financial goals.

Concluding Remarks

By understanding the complexities of student loan payments and exploring the available options for managing them, students can make informed decisions that will help them navigate their financial future with confidence.

Answers to Common Questions

What is the formula for calculating student loan payments?

The formula for calculating student loan payments is: Monthly Payment = (Loan Amount x Interest Rate) / (1 – (1 + Interest Rate)^(-Number of Payments))

How can I reduce my student loan payments?

There are several ways to reduce your student loan payments, including refinancing, loan consolidation, and income-driven repayment plans.

What are the benefits of using online tools for student loan payment calculations?

Online tools for student loan payment calculations can help you quickly and easily estimate your monthly payments, compare different repayment options, and track your progress over time.